From Allowance Calculations to Payslip Distribution: Improving HR Efficiency with Payroll Automation

2025-05-15

Payroll is essential to business operations, and ensuring employees are paid accurately is key to building trust. However, many companies still rely on complex manual processes, exposing themselves to errors and legal risks.

In contrast, automated systems reflect working hours and allowances in real time, automate payroll calculation and payment, and improve operational efficiency. HR managers can then focus on strategic initiatives rather than repetitive tasks, while companies achieve accurate and transparent payroll management.

This article explores the need for payroll automation, key considerations, and how to implement it effectively.

What Is Payroll Automation?

Payroll automation refers to a process where working hours, allowances, and deductions are automatically calculated and linked to payroll through a system. It often extends beyond calculation, covering tax deductions and reporting, payslip distribution, and automatic reflection of statutory allowances.

In traditional manual payroll, attendance data is entered manually and processed into payroll. With automation, clock-in/out records, leave, and overtime or night work data are updated in real time, ensuring accurate payroll calculation and payment.

Why Payroll Automation Matters

1) Optimized Labor Cost Management

Payroll automation systems precisely manage employee working hours and payroll data. They ensure accurate measurement of actual hours worked, while also forecasting costs from overtime and extra hours. Automated processes reduce labor costs, improve budget management, and provide structured payroll data that supports corporate financial planning.

2) Compliance and Risk Reduction

By automatically calculating allowances and deductions according to labor laws, minimum wage laws, and tax regulations, payroll automation minimizes legal risks. Accurate calculation of overtime, night, and holiday allowances ensures compliance, prevents underpayment of minimum wage, and reduces tax reporting errors. This prevents labor disputes and supports audits and tax reporting with reliable data.

3) Reduced Workload for HR Managers

Automating repetitive tasks such as payroll calculation, tax reporting, and allowance management reduces HR workload. This enables HR teams to focus on strategic initiatives such as workforce planning and employee benefits. Real-time payroll data access also improves efficiency and ensures quick responses to potential errors.

4) Increased Employee Satisfaction and Trust

Accurate and transparent payroll boosts employee trust and satisfaction. Automation prevents delays or errors in payment, while automatic payslip distribution improves transparency. Employees can review their hours and payroll at any time, reducing inquiries and misunderstandings and strengthening trust between employees and the company.

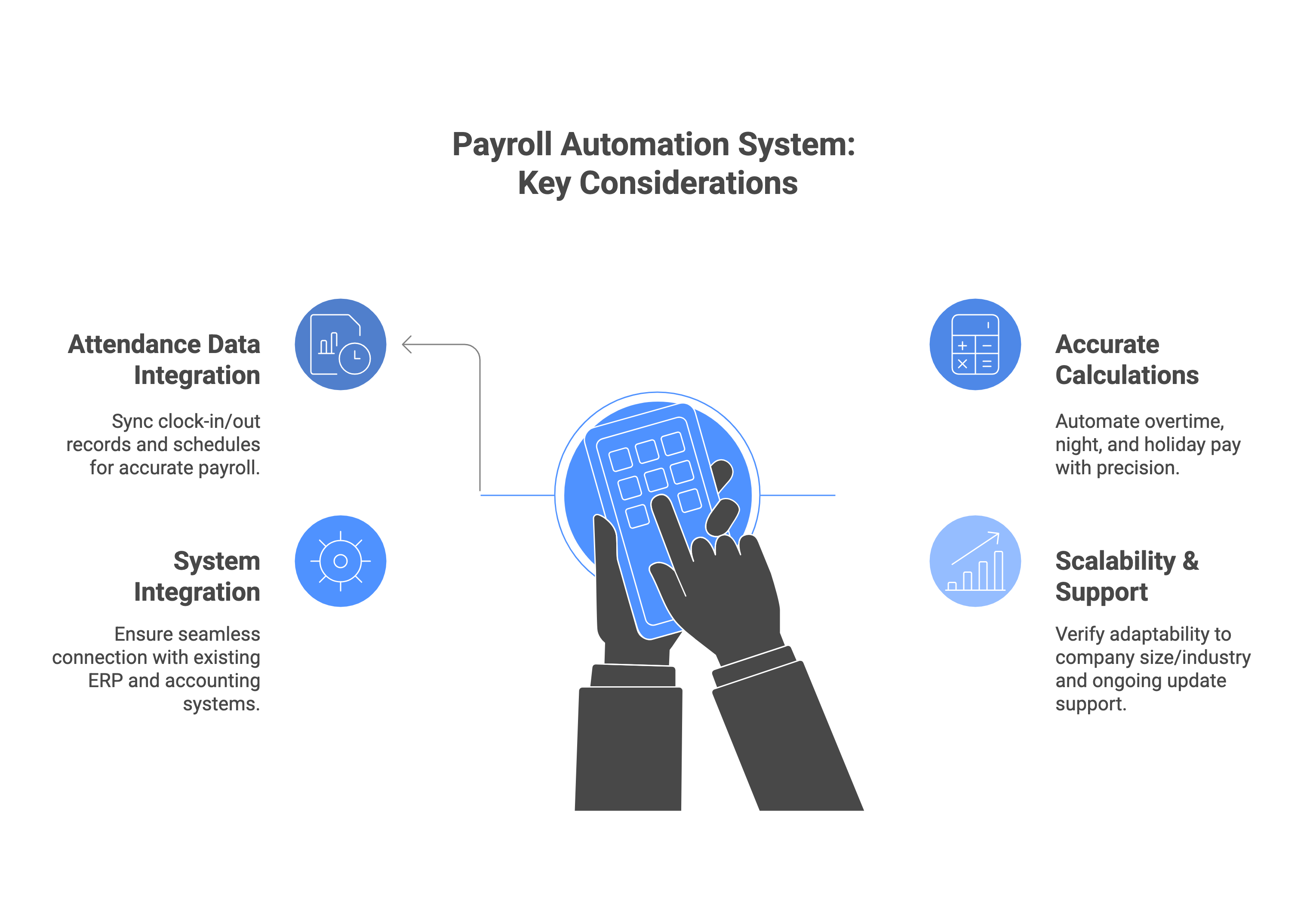

Key Considerations When Adopting Payroll Automation

1) Integration with Attendance Data

For accurate payroll automation, attendance records and schedules must be synchronized. Integration with an attendance management system allows working hours to be automatically aggregated for payroll. Leave, overtime, and night work data should also be reflected in real time to ensure accuracy.

2) Overtime, Night, and Holiday Pay Calculation

Payroll automation must include functions to calculate overtime, night, and holiday hours accurately by comparing schedules with actual attendance data.

- Overtime and holiday hours : Automatically calculate hours worked beyond regular schedules and on holidays or rest days.

- Remaining allowable hours : Provide real-time checks on maximum allowable overtime within a given period.

- All extra working hours : Aggregate all overtime, night, and holiday hours for additional pay calculation.

- Automatic classification of tardiness, early leave, and absence : Compare actual attendance with schedules to classify and automatically classify and record tardiness, early leave, and absences automatically.

3) ERP and Accounting System Integration

Payroll data should integrate seamlessly with ERP and accounting systems. Real-time reflection supports accurate financial management across the organization. Linking payroll data with existing accounting systems reduces duplicate entries and verification processes.

4) Scalability and Maintenance Support

Payroll systems must scale with organizational growth. Check whether the solution provides scalability, continuous updates, and maintenance. Systems that automatically reflect regulatory changes ensure stability. Flexible configurations for remote work, flexible hours, and shifts are also essential.

Payroll Automation with Shiftee, Integrated with Attendance Data

Integrated Attendance Management Based on Work Schedules

Shiftee unifies attendance management based on agreed work schedules, leave schedules, and actual clock-in/out records. This enables accurate reporting and compliance checks against labor law, with real-time updates that reflect changes immediately.

Real-time Attendance Statistics

Shiftee uses real-time attendance data to help managers and employees easily check working hours, overtime status, and weekly average hours anytime, anywhere. Employees can clearly see their own working hours, while managers can instantly monitor organizational attendance, making it effective for managing flexible work arrangements. Shiftee also provides reports that can be used immediately as internal documents and allows users to select a period and team/location to easily download attendance reports.

Automated Calculation of Base and Additional Pay

Shiftee automatically calculates both base pay and additional allowances based on employees’ actual working records. In addition to base pay, it calculates extra allowances such as weekly holiday pay, overtime pay, night work pay, and holiday pay, and exports the results to Excel. This greatly reduces the burden of manual calculations and minimizes errors during payroll processing, providing highly reliable payroll data.

ERP and Accounting System Integration

Shiftee integrates with a wide range of ERP and accounting systems, enabling flexible operations that fit the scale of any organization. By connecting with systems such as SAP, Workday, and Oracle, payroll data is reflected in real time, making payroll processes more efficient. This minimizes duplicate data entry and verification tasks, helping companies save time and reduce administrative workload.

Automatic Payslip Distribution

After payroll is completed, Shiftee automatically generates and distributes payslips to employees. As recent labor law amendments require all companies to issue payslips, automating this process reduces HR workload and provides employees with timely payroll information. Employees can check accurate payroll details in real time, which decreases payroll-related inquiries and enhances trust within the organization.

Payroll automation is not just about reducing HR workload—it is a strategic approach to improving operational efficiency and minimizing legal risks. Accurate payroll builds employee trust and plays a key role in creating a transparent work environment. With an automated payroll system, companies can calculate overtime and holiday allowances accurately, generate payslips in real time, and prevent unnecessary disputes.

By adopting Shiftee, companies can ensure error-free payroll processing while significantly reducing HR workload. Experience payroll automation today with Shiftee’s free trial.

Payroll Automation with Shiftee

When citing the content, be sure to indicate the source according to copyright law.